Professional Money Management

Dr. Doug Yang

Investment Adviser

Why Professional Money Managers?

- "According to a groundbreaking study by Vanguard, using a professional adviser can possibly add about net 3% annually to the value of your assets, after fees are taken into account." -- from Kiplinger

- “Peter Lynch, who formerly managed the high-flying Fidelity Magellan Fund from 1977 to 1990, is a legendary investor. Under his management, the fund averaged an astounding annual return of 29%.” “According to Fidelity Investments, the average Magellan Fund investor lost money during Lynch’s tenure there.” -- from Forbes

- The average investor has lost a lot of wealth in the long term, due to managing money themselves.

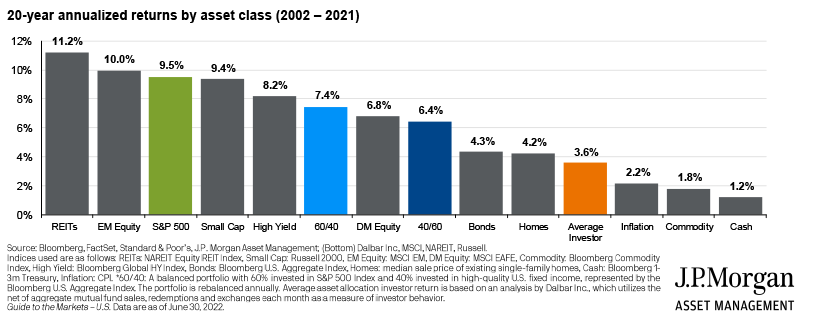

Based on "Guide to the Markets", J.P. Morgan Asset Management, June 30, 2022, the average investor returned 3.6% annually

in the 20-year period from 2002 to 2021, while the S&P 500 index returned 9.5% and the 60/40 portfolio returned 7.4% respectively:

Which Professional Money Managers?

Where your money will be held?

Recent Performance of Sample Money Managers

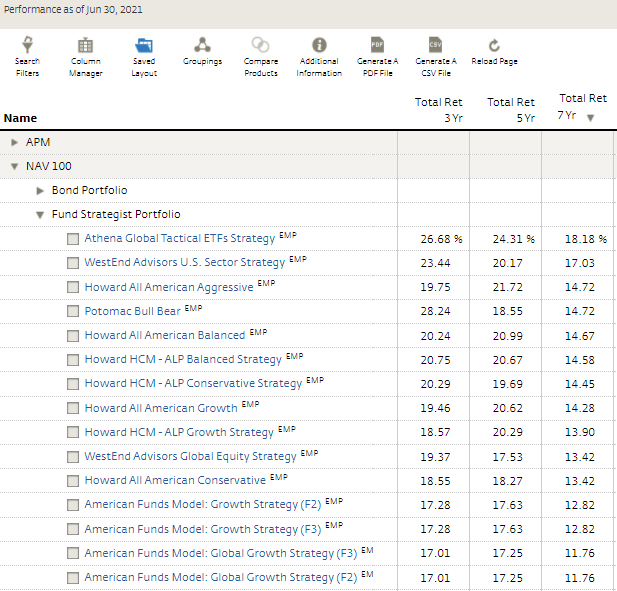

Mutual fund/ETF accounts

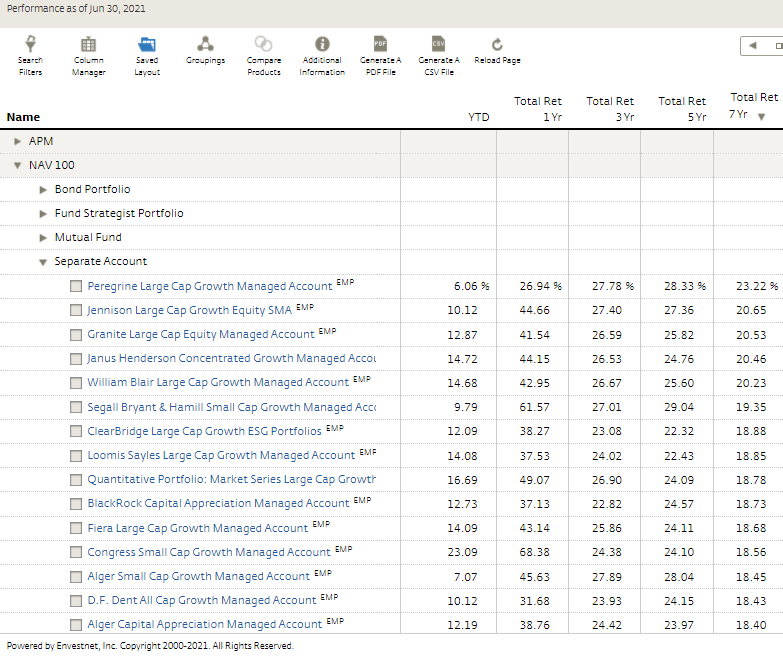

Stock accounts

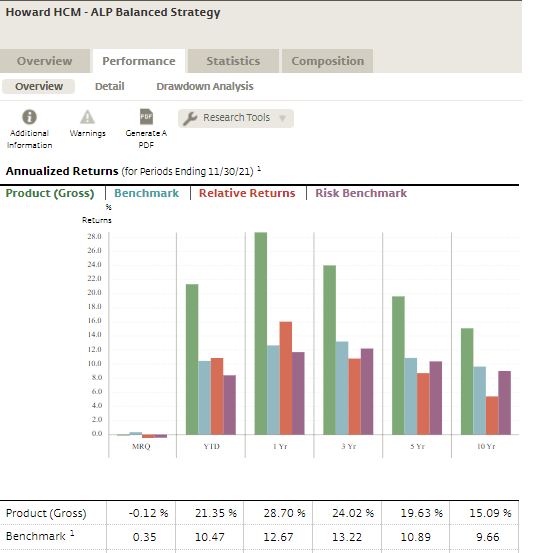

Howard HCM - ALP Balanced Strategy

-

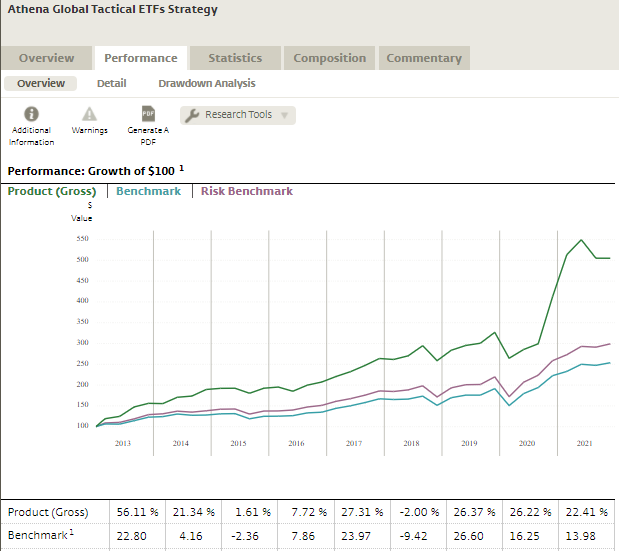

Athena Global Tactical ETFs Strategy

Cost Structures

-

Account 1: 70% of the account is managed by JP Morgan (Global Standard Strategy)

and 30% managed by

DoubleLine

(Shiller CAPE Enhanced Return Strategy).

Account custodian is Schwab or AssetMark Trust.

Account Balance Total Management Fees Up to $250K 0.88% $250K -- $500K 0.69% $500K -- $1M 0.59% $1M -- $2M 0.53% $2M -- $3M 0.46% $3M -- $5M 0.37% Over $5M 0.30% -

Account 2: 50% of the account is managed by Howard HCM (ALP Balanced Strategy),

40% managed by Capital Group (American Funds Global Growth Strategy, no load),

and 10% managed by Athena (Global Tactical ETFs Strategy).

Account custodian is Schwab.

Account Balance Total Management Fees Up to $100K 0.903% $100K -- $250K 0.853% $250K -- $500K 0.753% $500K -- $1M 0.553% $1M -- $3M 0.478% Over $3M 0.403%

Take Action Now

Professional Money Management -- the same high quality professional money managers, but at a lower cost, and with one account possibly managed by multiple money managers.

This page is for general information only and is not intended to provide specific advice

for any individual.

All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal.