DoubleLine Shiller Enhanced CAPE Strategy

Dr. Doug Yang

Investment Adviser

What is This Strategy?

Shiller Enhanced CAPE Return Strategy is offered by DoubleLine Capital.

The equity portion of the portfolio uses derivatives on the Shiller Barclays CAPE US Core

Sector Index, which is

a rules-based approach to identify the five cheapest US equity sectors using

Noble Prize Winner Dr. Robert Shiller's modified cyclically adjusted price-to-earnings (CAPE) ratio.

The fixed income portion of the portfolio is actively managed by DoubleLine's fixed income team

to provide additional source of value.

This strategy

emphasizes on valuation and should lead to higher risk-adjusted performance on a long-term basis.

What is its Past Performance?

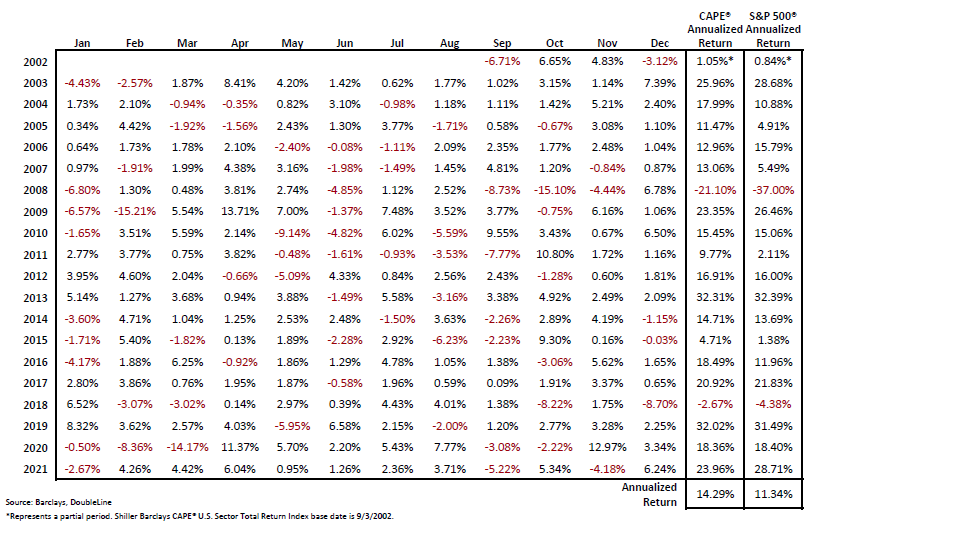

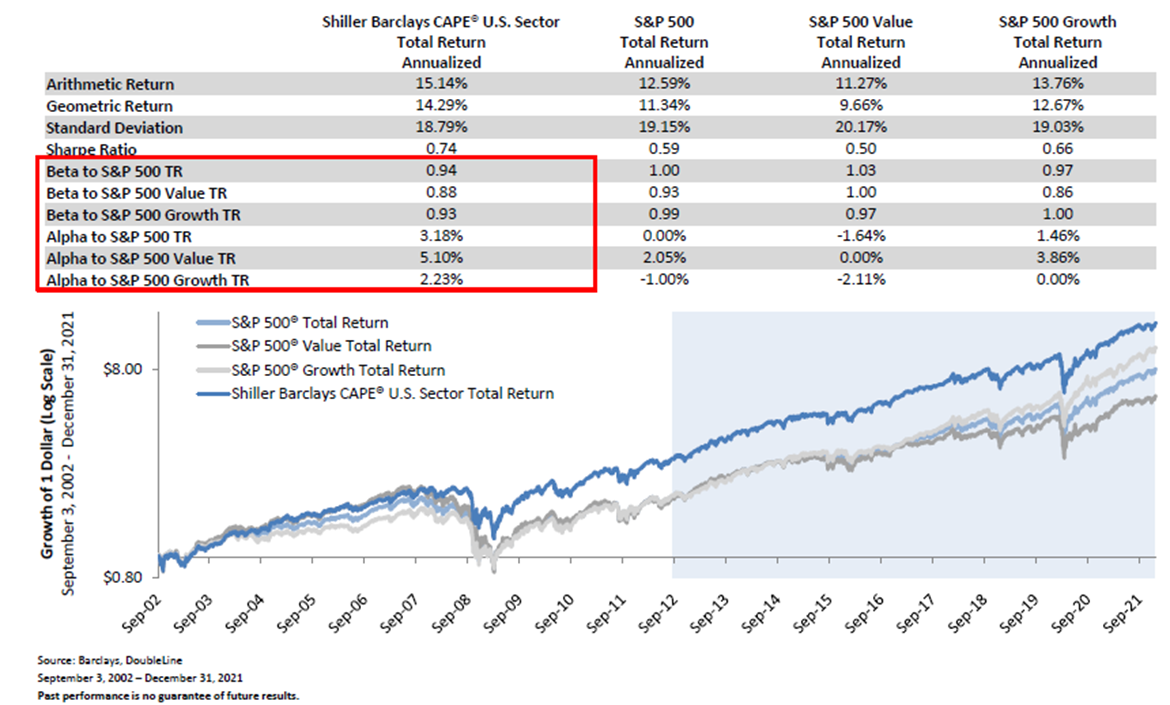

The following two pictures show its recent performance. For the past about 20 years, this strategy

has performed an average annual return of 14.29%, compared to 11.34% for S&P 500 index,

while having lower volatility (beta: 0.94) and higher alpha (3.18%) than S&P 500.

-

Average Annual Return

-

Beta and Alpha

How to Best Utilize This Strategy?

Shiller Enhanced CAPE Return Strategy is mostly an equity portfolio.

DoubleLine Capital is one of the best professional money managers that we partner with.

Typically we select two or more professional money managers to manage a client's account.

Each money manager would manage a percentage of the assets in a client's account. Some managers

may employ aggressive tactical strategies while others may use strategical strategies. This is sometimes called money manager diversification

and may help improve the risk and return profile of an account over the long term. DoubleLine Capital's this strategy may be used

for a portion of a diverfified portfolio.

Take Action Now

There is no simple get-rich-quick way in investing. Compounding requires time.

Take action now and results may show up years later. Delaying taking action will delay results.

In the world of investing, a good strategy and time are your best friends.

This page is for general information only and is not intended to provide specific advice

for any individual.

All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal.